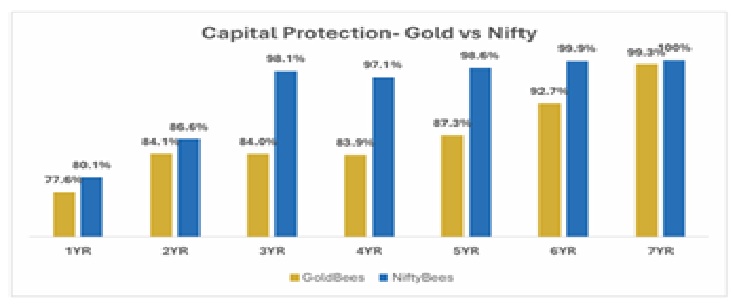

An equity investor with 3-year holding period has higher chance of capital protection than one holding gold for similar period.

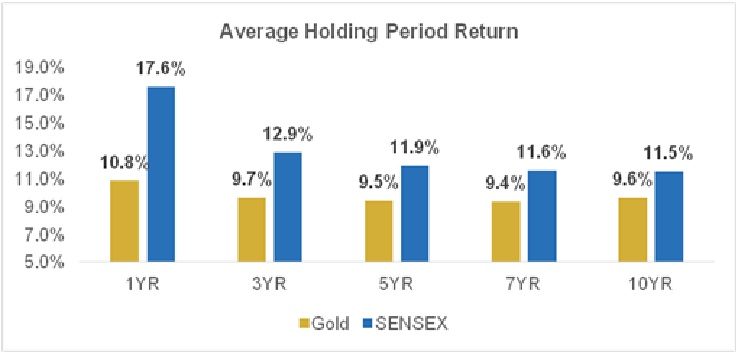

Mumbai, 17 October 2025: In the light of gold breaching the $4,000/oz (₹114,761 per 10g) mark OmniScience Capital in its study – Gold’s Glitter vs. Stock’s Sparkle cited that rolling period analysis for the long-term period of 1990 to 2025 shows that Equities (Sensex 30) have consistently delivered higher returns over Gold with average return of approx. 11.5% (Sensex 30) vs. 9.5% (RBI Gold Prices).

Analysis of more recent period using GoldBees data also indicate that for holding periods of three years and beyond, Nifty50 consistently delivered superior average returns over Gold. Nifty consistently delivered on average around 11.5% against 8%-10% range for Gold. With around 6,400 1-year rolling periods during the 18 years, and more than 3,100 10-year rolling periods, the data is rich.

Annexure: Based on this historical data, what are the chances of preserving capital over different holding periods?

There is a high (98.1%) probability of protecting one’s capital in Nifty for holding periods of 3 or more years. This means that historically, an equity investor with a holding period of 3 years or more had an exceptionally high chance of not losing their principal investment. In stark contrast, Gold provided only an 84.0% chance of capital protection over the same 3-year window.

According to OmniScience Capital, to achieve a comparable level of safety (over 99%), the Gold investor needed to remain invested for a much longer period of 7 years to reach a 99.3% probability.

Ashwini Shami – President and Chief Portfolio Manager, OmniScience Capital, says “Over long investment horizons, equities are superior at both preserving capital and generating significant returns above inflation. Gold’s role is best kept as a modest hedge, ideally not exceeding 10–20% of a portfolio.”

OmniScience Capital’s report also provides a comprehensive quantitative analysis, comparing the investment performance of Gold (INR) vs. Nifty 50 for the Indian markets and Gold (USD) vs. S&P 500 for the US markets.

Indian Equities versus gold

This year witnessed record inflows into gold ETFs; ₹8,363 crore in India and $15 billion globally. Hence, the study compares gold ETF (GoldBees) and the Nifty50 ETF (NiftyBees) from the inception of the gold ETF in the Indian market (March 2007) until September 2025.

Although a point-to-point analysis of the returns might indicate better performance on the part of gold, especially due to its recent surge, the benchmark index delivers long-term returns of ~11.5% per annum versus the yellow metal’s 8–10%.

Gold as an investment Globally

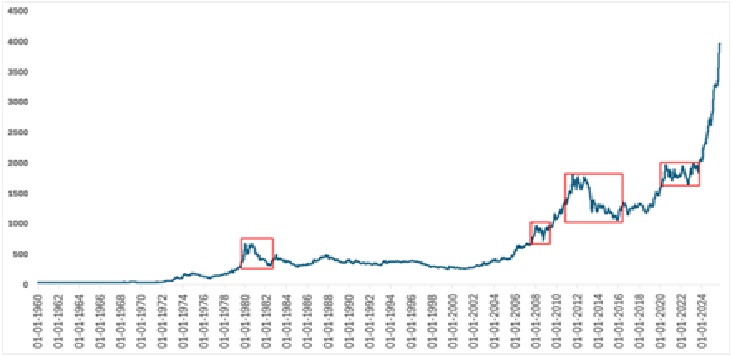

After analysing the data for Gold ($ per Ounce) in the US markets, which is available from 1915, the chart shows that gold prices can significantly spike specially during macroeconomic crisis and then crash significantly once the crisis is over. The percentage fall post the crisis is shown in the table below. The range of drawdowns is -17% to -44%.

US Equities versus Gold

Comparing the S&P500 against global gold prices, the benchmark index returned about 9.4% annually over the last 40 years, against 5% for gold. The analysis highlights once again the abilities of equities to deliver better returns.

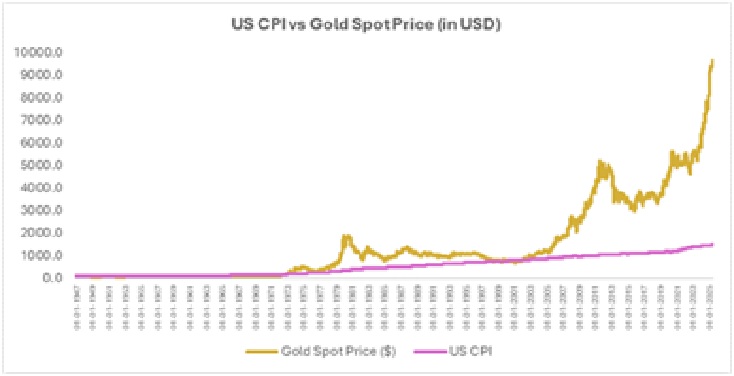

Is gold actually a hedge against inflation?

The study showed a –11.5% correlation between the U.S. Consumer Price Index (CPI) and Gold (USD) and a –1.5% correlation between India’s CPI and Gold (INR). This suggests that gold prices move largely independent of inflation in both India as well as in US. Instead, the price of gold seems to react more to factors such as global interest rates (U.S. Treasury yields, specifically), movements in the USD, Central bank buying, and the risk sentiment of investors.

The study concludes that although gold remains a safe-haven asset, equities, both Indian and global, are superior as a wealth builder in the long term, beating inflation consistently.

About OmniScience Capital Advisors Pvt. Ltd.

OmniScience Capital is a Global Investment Management firm focused on global equity investments empowered by its proprietary Scientific Investing philosophy.

For More Information and Support | https://www.omnisciencecapital.com/

Ayesha Aryan Rana | C. Janardhan | Aaryana Matasco 7700029963 | ayesha.aryan@aarayana.ind.in | aaryanamatasco@gmail.com

Leave a comment